Resource Library

Making Our Homes More Efficient: Clean Energy Tax Credits for Consumers

Overview

Read about potential eligibility for tax credits for using eco-friendly technology at a home, building, or property.

Quick Links

Frequently Asked Questions

Q: Who is eligible for tax credits?

A: Homeowners, including renters for certain expenditures, who purchase energy and other efficient appliances and products.

Q: What do consumers do to get the credit(s)?

A: Fill out IRS Form 5695, following IRS instructions, and include it when filing your tax return. Include any relevant product receipts.

Q: Are there limits to what consumers can claim?

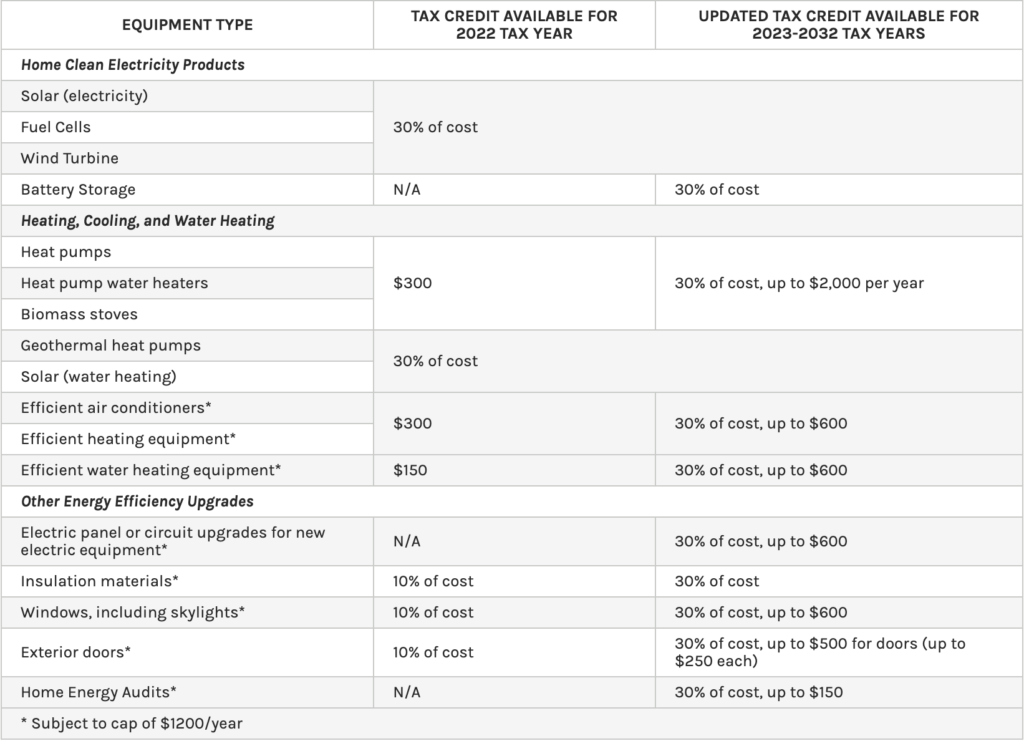

A: Consumers can claim the same or varying credits year after year with new products purchased, but some credits have an annual limit. See the table above.

Q: How do consumers find qualified professionals to conduct home energy audits?

A: Visit /energysave/professional-home-energy-assessments.

Fore more FAQ and Information, click the resource link below.

Related Resources

NESP: Methods, Tools and Resources Handbook

Download and view the manual which provides technical information on how benefits and costs of DER investments can be quantified (monetized or otherwise), with links to resources and tools.

Building Science: Remodeling Old Homes

Watch to learn about the building science of remodeling old homes.